It’s better to have a vacant property than a bad tenant who will smash up the unit and stop paying rent. Evictions are no fun to go through and quite expensive. And turnover tends to be one of the biggest expenses that property owners have. Unfortunately, screening requires some work and is not simply a box you get to check off.

Screening Tenant Prospects

First things first, you should always do a background check on every applicant no matter how good or bad a feeling you have about them. And Fair Housing does not look kindly on landlords telling prospects they should not apply.

Now, most property managers and landlords wish screening prospects was something like this:

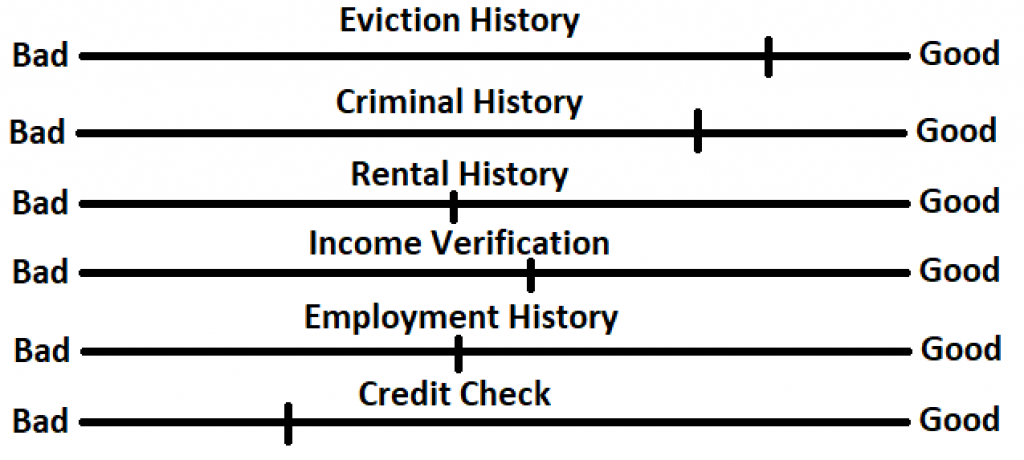

Unfortunately, there are multiple things we are looking for. Namely:

- Eviction history

- Criminal history

- Rental history

- Income verification

- Employment history

- Credit check

So it looks something like this, with each line representing the minimum acceptable standard for each of the six items we are investigating.

That being said, you probably do not want to accept someone who only meets the absolute minimum standard in each category. This is when screening tenants gets complicated. I will return to this scenario at the end after we cover the basics.

A Few Notes

Before digging into each item to screen for, a few quick notes. The most important is a simple one: DO NOT DISCRIMINATE!

HUD lists seven protected categories that you may not discriminate against:

- Race

- Color

- National origin

- Religion

- Sex

- Familial status

- Disability

Related: More than 300,000 NEW residents move to Florida every year

In addition, many states, as well as some cities and municipalities, have additional categories you cannot discriminate against. Missouri law, for example, includes ancestry as a protected class and many states prohibit discrimination based on sexual orientation or gender identity.

If you are managing for yourself, it’s a good idea to consult an attorney to make sure your screening criteria are in compliance with Fair Housing and your state laws before you begin.

Furthermore, I would recommend having a third-party company do both the background check and the income/rental history verification. You can do the second part yourself, but there is a tendency for you to want to see the best in the applicant as you want to get the unit rented.

Confirmation bias can hurt you here. A third-party screening company doesn’t care and will give you “just the facts.” I use Red Star, but there are many such screening companies out there to choose from.

Finally, make sure your rental criteria are in writing and you stick to them as best as you possibly can. Don’t just shoot from the hip when it comes to screening. If you get sued, you definitely will want this written criteria to reference.

Now, let’s turn to the items to look at.

Eviction History

This one is pretty simple. If someone has been evicted, it is much more likely it will happen again. I do not accept evictions for the previous seven years and recommend demanding a significant amount of time has passed since a previous eviction. Or simply, don’t allow evictions at all.

You will also want to consider what to do about satisfied evictions (where the tenant was evicted but paid off the back rent and costs of the eviction). Perhaps view these more leniently.

Criminal Background

This one can be a bit tricker than evictions because there are many different types of crimes of varying severity. You may decline all violent felonies, all felonies for at least five years (perhaps with the exception of a DUI) or more than two misdemeanors in the past five years. (Or something like that.)

Unfortunately, it will have to be a bit arbitrary but make such selections as best as you can and stick to them. This is probably the most important area to have written policies about.

Rental History

You want to at least confirm the previous year of rental history. You should, at the minimum, get the rental history from their previous landlord. While it’s preferable to get it from their last two landlords, this can be difficult to attain sometimes. The big things you are looking for are:

- Prospect left the previous unit in good shape.

- Prospect paid for damages (if any).

- Prospect had few late pays (I want one or less in the previous 12 months).

- Prospect had few or no complaints against them or lease violations

- Prospect fulfilled their lease in full and did not break it. (Or if they did break it, they paid whatever lease-breaking fee the landlord had in place.)

Income Verification

The prospect should make at least three times the rent in monthly income, and this should be verifiable income (i.e., not “under the table” money). There are, however, a few caveats to this.

In more expensive markets, such as Manhattan and San Francisco, the 3x rent threshold is often unreasonable (and sometimes restricted by law). In such areas, 2.5x rent or occasionally 2x rent may be acceptable.

Furthermore, if you are accepting Section 8 or tenants benefiting from another rental assistance program, you will need to adjust your income requirements accordingly.

Related: 13 Home Improvement Ideas for Anyone on a Budget

Employment History

It is generally not wise to accept someone who just started at their new job the day before applying. Preferably, you will want them to be on the job for at least a year. This is something you can give a little ground with though. Maybe ask for a double deposit if your state law permits.

Furthermore, young people who just left their parents’ house or graduated college likely won’t have any employment history. In these cases, you may consider getting a cosigner, which you can read more about here. (You could also require a cosigner if the applicant has mediocre or no credit, or falls just below the income requirement—say between 2.5 and 2.9x rent.)

Credit Check

The scores are nice, but the report is more helpful. I aim for a score of at least a 600, but need something above 500. Regarding the report, the big thing I look for is charge-offs from property management companies. Those are a big red flag.

Putting It All Together

Unfortunately, sometimes someone will be just above the minimum criteria in multiple areas. For example, someone could have a recent misdemeanor and a 10-year-old, nonviolent felony, barely hit your income requirements, had a late payment, and only a 520 credit score.

In this case, I’d probably say no. That’s because I have red flags (recent evictions, violent felonies, etc.), which are automatic noes and yellow flags (misdemeanors, late pays, etc.). Too many yellow flags also means denial.

And, yes, you should have this criteria written down as explicitly as possible. While you can’t have it written down for every possible scenario, you should be as detailed as possible.

There are also groups of individuals who apply together. In such a case, each applicant needs to hit the minimum standards. Even if four are perfect and one doesn’t hit, that group gets denied. (Or, at least, the group is only approved if the one who was denied drops out.)

Screening often requires resisting temptation. Remember, a bad tenant is worse than a vacant property. Every buy and hold investor who’s been in this game for more than a few months will tell you that.

You can’t accept everyone and expect to have good residents, and you can’t simply wait for the perfect prospect to come around and expect to ever have an occupied property. Tenant screening is a balancing act—and it’s a balancing act for which you need to determine the rules ahead of time.

Again, screening is an area you should be very careful with as there are a lot of laws on the books about this. So look over the laws carefully (both state and federal) and consult your attorney before you start.